1. Calculate Your Personalized Home Loan Rate - TD Bank

Use our free Home Lending and Mortgage Calculator to explore lending options for purchasing a home, refinancing your mortgage, and getting cash out of your ...

Use our free Home Lending and Mortgage Calculator to explore lending options for purchasing a home, refinancing your mortgage, and getting cash out of your equity.

2. Mortgage Calculators - TD Canada Trust - TD Bank

Mortgage Payment Calculator · Down Payment Calculator

Use our TD mortgage calculators to calculate your mortgage payments. Use our tools to find the best mortgage solution that works for you and compare options. Our mortgage calculators can help you discover the estimated amount for your monthly mortgage payments based on the mortgage option you choose.

3. Home Equity Calculator - TD Personal Banking, Loans, Cards & More

Let's find the rates and terms to go with the loan you need. Just fill in the info below and we'll take it from there. Please fill in all fields.

Enter your current loan info to see how much you could save by making more than the minimum payment each month.

4. Loan Prepayment Calculator Results - TD Bank

The home equity calculators and amortization schedules are for illustrative purposes only. ... Having trouble making your mortgage or loan payments? Learn how we ...

Site Map | Privacy | California Privacy | Online Advertising | Security | Accessibility | Terms of Use | Bank Deposits FDIC Insured | Equal Housing Lender

5. TD Bank Mortgage Payment Calculator - Ratehub.ca

Use our Saskatoon mortgage calculator to determine your monthly mortgage payment for your home purchase in Saskatoon.

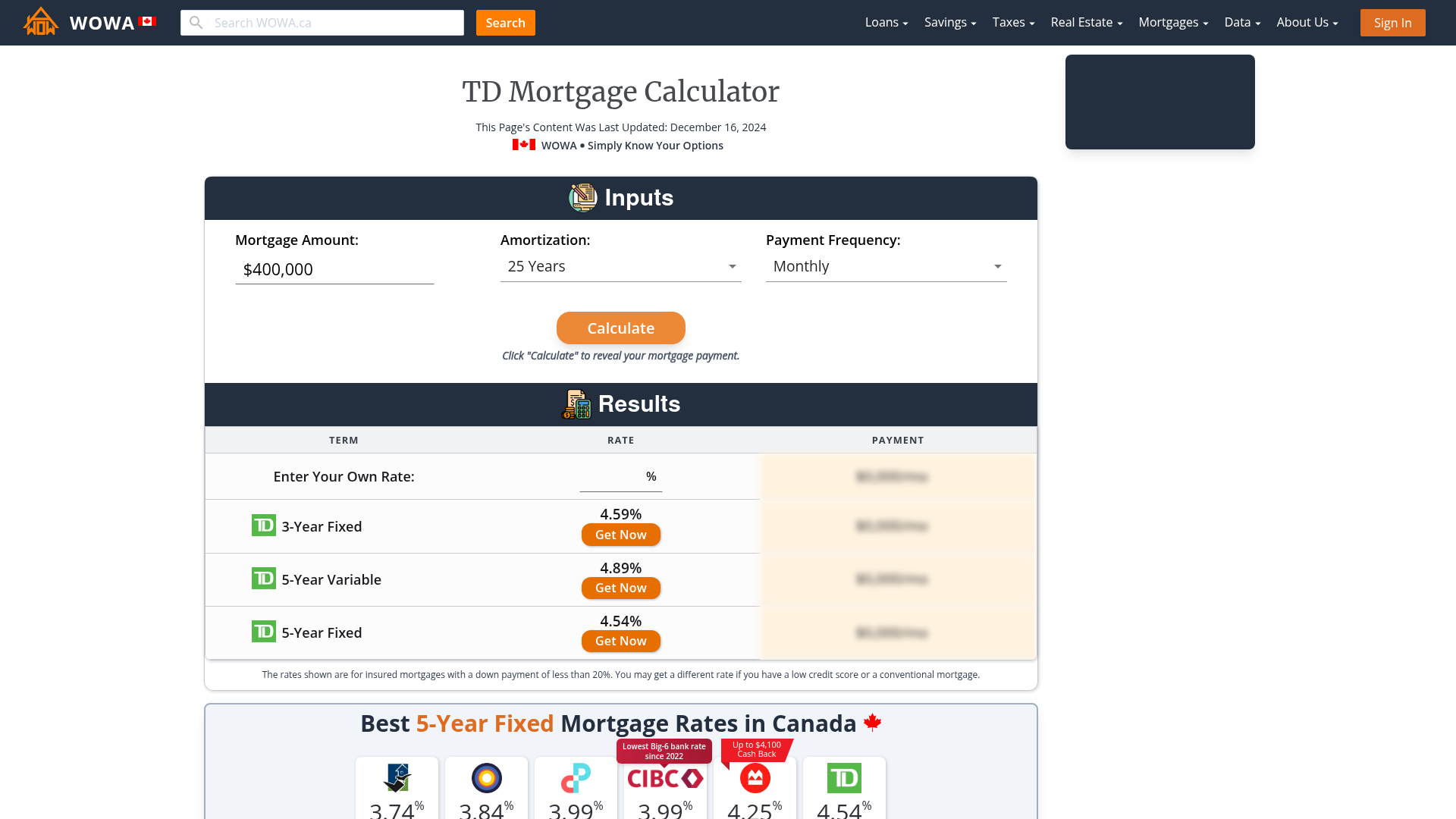

6. TD Bank Mortgage Payment Calculator Jun 2024 | WOWA.ca

Find TD Bank mortgage payments with this easy-to-use calculator. Compare payments with different rates. Fixed vs. Variable. Monthly vs. Bi-Weekly Payments.

Find TD Bank mortgage payments with this easy-to-use calculator. Compare payments with different rates. Fixed vs. Variable. Monthly vs. Bi-Weekly Payments. Amortization terms.

7. TD Bank Mortgage Calculator in the USA Online - Finanso

The TD Mortgage Calculator is a tool provided by TD Bank to help potential homebuyers estimate their monthly mortgage payments. The calculator takes into ...

TD Bank Mortgage Calculator online in 2024 in the USA. Calculate the monthly payment, the amount and the rate on the loan. An illustrative repayment schedule in dollars

See Also40+ DIY Valentine's Day Boxes

8. TD Mortgage Rates – Forbes Advisor Canada

6 days ago · TD provides an online mortgage affordability calculator to help you estimate your home-buying budget. Determine your down payment. The size ...

We review the mortgage rates and products offered by TD Bank to let you know whether its rates are worth going with.

9. Mortgage Calculators - TD Finance LLC

Use this calculator to see the difference between a 15 year and a 30 year mortgage. Calculate. Compare 2 Loans Calculator. Compare 2 different loan scenarios to ...

Amortization calculator, closing cost calculations, and other mortgage tools offered by TD Finance LLC

10. TD Bank Mortgage - Refi.com

Jan 30, 2024 · Construction Loans: For those looking to build a new home, TD Bank ... Auto Loan Calculator · HELOC Calculator: How Much Can I Get? Interest ...

TD Bank, short for Toronto-Dominion Bank, is a prominent financial services group based in Canada. In the United States, TD Bank operates as a major national bank and is among the ten largest banks in the country. TD Bank offers various banking products and services, including personal and business banking, loans, mortgages, and investment services.

11. TD Mortgage Rates - NerdWallet Canada

If you're worried about the impending cost of your home loan, keep these strategies in mind. Clay Jarvis · Canada Closing Costs Calculator.

View and compare current TD mortgage rates. Find the right fixed, variable, open or closed TD mortgage rate for your home buying needs.

12. TD Bank Mortgage Review 2024 - Bankrate

Dec 13, 2023 · Auto loan calculator · Auto loan refinancing guide · How to get the best ... It offers a range of loan options, including jumbo loans and the TD ...

With more than 1,100 locations, TD Bank is one of the biggest banks in the U.S. Learn more about TD Bank's mortgages and compare this lender to others.

13. TD Bank Mortgage Rates | See This Week's Rates | SmartAsset.com

Jul 26, 2022 · TD offers at least four different styles of these loans, including conventional, jumbo, HomeReady and Right Step. The majority of customers will ...

Compare current mortgage rates across a variety of mortgage products from TD Bank. Apply for a mortgage today.